maryland ev tax credit 2020

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. Clean Cars Act of 2022.

Tesla Model 3 Tax Credit 2020 Off 78

16 Sd The UBJECT TO SUBSECTION E OF.

. May 11 2020 Thread starter 1 It looks like the 3K Maryland EV excise tax credit was allowed to expire. Some other notable changes include. The states existing Electric Vehicle Supply Equipment Rebate Program has very limited funding for the remainder of the 2020-21 fiscal year which ends June 30.

Last First Middle Initial 2. In January the Clean Cars Act of 2020 was introduced to extend the program for another three years. The Clean Cars Act of 2021 HB 44 proposes to extend and increase the funding for the Maryland electric vehicle excise tax credit.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. Clean cars act of 2020 uncertain. Maryland ev tax credit 2020.

Funding Status Update as of 04062022. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration.

As a new resident of Maryland you must title your vehicle within 60 days of moving to Maryland. Tax credits depend on the size of the vehicle and the capacity of its battery. 893 of the funds budgeted for the FY22 EVSE program period have been committed with 19258900 still available.

13 2017 2020 but before July 1 2020 2025. Renters tax credit application form rtc 2022 the state of maryland provides a direct check payment of up to 100000 a year for. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per.

Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles. Maryland state legislation could increase the tax credit received for electric cars to 3000 per vehicle. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

The maryland clean energy incentive act provides tax credits up to 2000 for electric vehicles evs. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and this amount can be up to 7500. President Bidens EV tax credit builds on top of the existing federal EV incentive.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. For model year 2021 the credit for some vehicles are as follows.

At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

4500 EV Tax Credit. For more general program information contact MEA by email at michaeljones1marylandgov or by phone at 410-598-2090 to speak with Mike Jones MEA Transportation Program Manager. February 11 2020.

2020Renters Tax Credit Application RTC-1 Form Filing Deadline. The clean cars act of 2020 proposes to increase the funding for the maryland electric vehicle excise tax credit. Maryland citizens and businesses that purchase or lease these vehicles.

14 c Subject to available funding a AN EXCISE TAX credit is allowed against the 15 excise tax imposed for a plugin electric drive vehicle or fuel cell electric vehicle. Maryland state EV tax credit has received some funding. If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year.

The credit has been underfunded for years last years credit was fully expended on the first day of the fiscal year paying out claims submitted from the prior year. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. The credit ranges from 2500 to 7500.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. I bought a Nissan Leaf back in April 2020 and desperate dealers eager to move their overflowing inventory what a difference a year makes were promising up and down that if I buy the EV today by summer time the state will free up some money and start handing out money as part of their recently fund depleted excise. Vehicle Registration Tax Credit.

Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies local and county. There is still a 7500 federal tax credit for many new EVs and it is likely that the General Assembly will once again debate a renewed state EV tax credit when it reconvenes in 2022. Decreasing from 63000 to 50000 for purposes of.

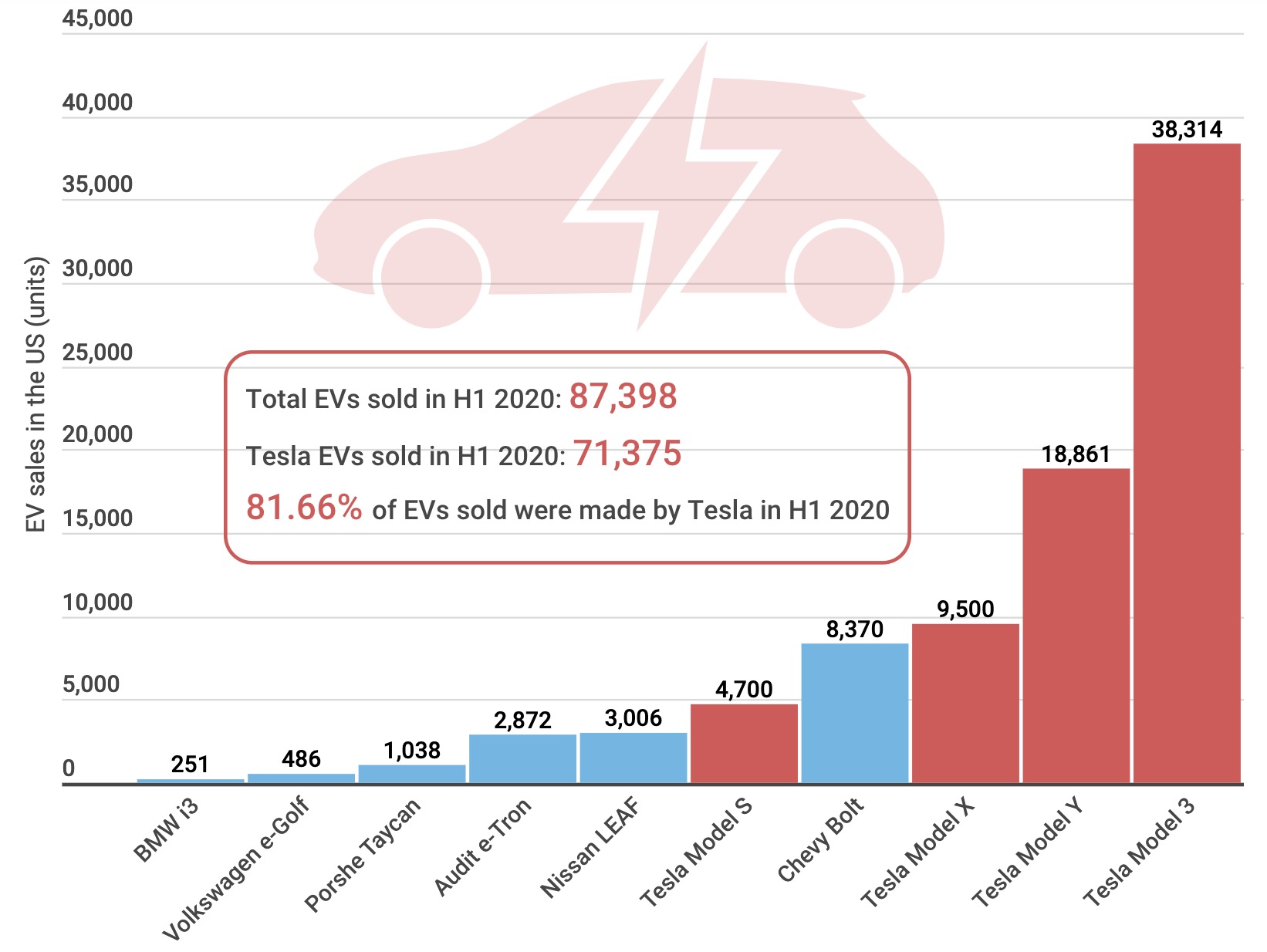

In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids.

Annual funding would increase to as much as 26000000 through fiscal year 2023 under the proposal by Delegate David Fraser-Hidalgo. Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit on a qualifying plug-in electric or fuel cell electric vehicle regardless of whether they own or lease the vehicle. Plug-In Electric Vehicles PEV Excise Tax Credit.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Tesla Model 3 Tax Credit 2020 Off 78

Maryland Energy Administration

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Tesla Model 3 Tax Credit 2020 Off 78

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Tesla Model 3 Tax Credit 2020 Off 78

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra